Homeowners Insurance in and around Eugene

Looking for homeowners insurance in Eugene?

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

One of the most important actions you can take for your loved ones is to make sure your home is insured through State Farm. This way you can sleep well knowing that your home is protected.

Looking for homeowners insurance in Eugene?

Give your home an extra layer of protection with State Farm home insurance.

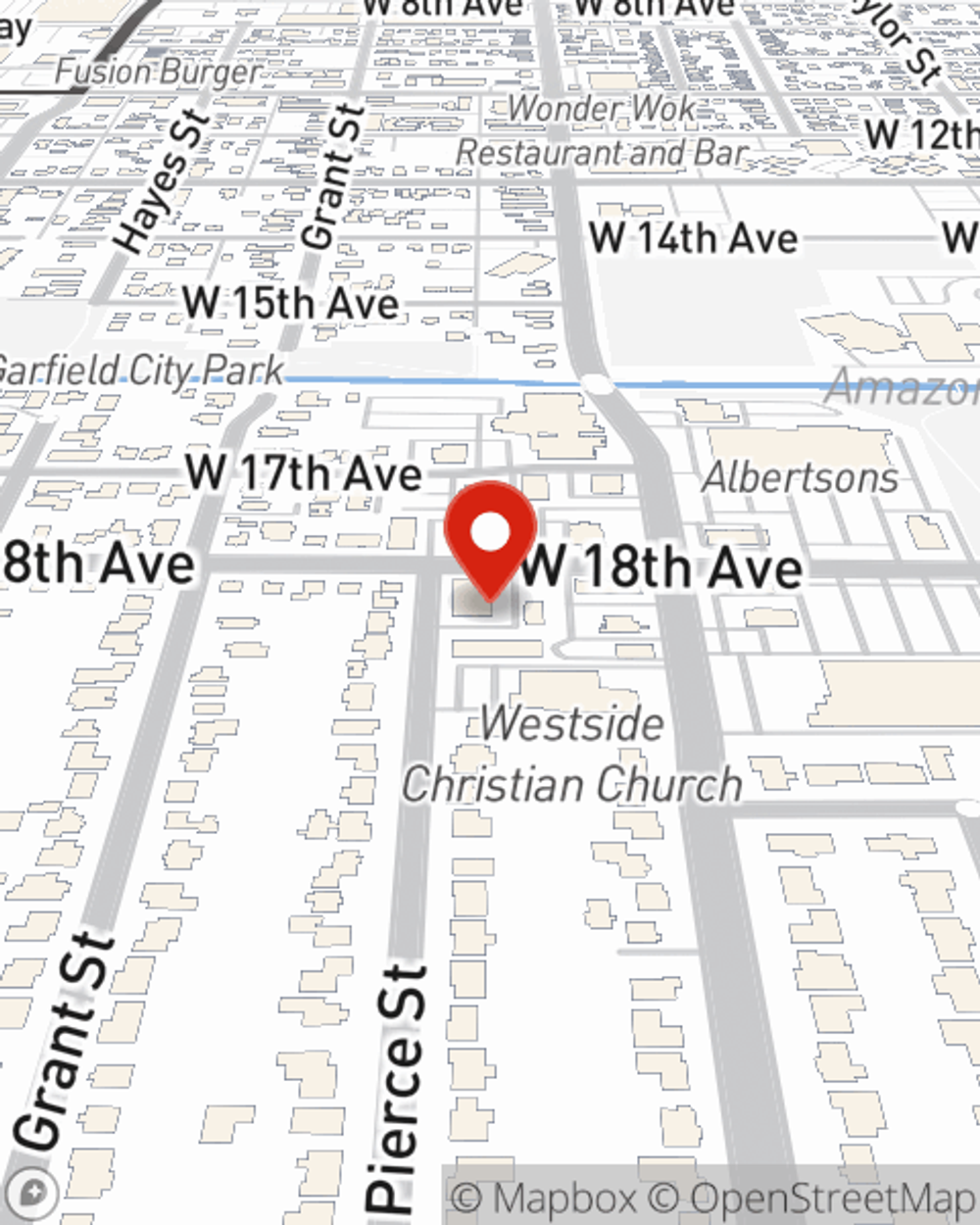

Agent Rob Olive Jr, At Your Service

From your home to your favorite hobbies, State Farm can help you protect what you value most. Rob Olive Jr would love to help you feel right at home with your coverage options.

It's always the right move to get coverage with State Farm's homeowners insurance. Then, you won't have to worry about the unanticipated windstorm damage to your property. Contact Rob Olive Jr today to learn more about your options or ask how to bundle and save!

Have More Questions About Homeowners Insurance?

Call Rob at (541) 686-1745 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to identify poisonous plants and flowers

How to identify poisonous plants and flowers

Aside from poison ivy and oak, be aware of these other poisonous plants that can be toxic to humans and pets.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to prevent bug bites

How to prevent bug bites

Spider and insect bites take the fun out of being outside. Discover ways to help avoid them and what to do if you get one.

Rob Olive Jr

State Farm® Insurance AgentSimple Insights®

How to identify poisonous plants and flowers

How to identify poisonous plants and flowers

Aside from poison ivy and oak, be aware of these other poisonous plants that can be toxic to humans and pets.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

How to prevent bug bites

How to prevent bug bites

Spider and insect bites take the fun out of being outside. Discover ways to help avoid them and what to do if you get one.